Montel Williams Will Still Loan You Money: How To Inherit An Elderly Relative's Credit Card Debt

The first thing I noticed the day I moved in with my grandmother was Montel Williams sitting on top of her unopened mail.

The first thing I noticed the day I moved in with my grandmother was Montel Williams sitting on top of her unopened mail.She's been in and out of the hospital over the past few months. After 84 years, her body just isn't holding together anymore. Worse, her memory and cognition are becoming unreliable. She was in terrible shape when my parents first hospitalized her, in denial about how poorly she was taking care of herself and the three-bedroom house my father built for her. Dirty dishes in the cabinets, a layer of dust over all the furniture, floors stained with what could only be dried vomit or worse... but she insisted that she could still take care of herself.

When she was first admitted to the hospital, my mother started handling her bills. Many of them were months overdue or, more worrying, paid more than once in the same period. One of the overdue bills was a credit card statement from Capital One, a card that my grandmother denied having, a card that was still being used while she was in the hospital. When my mother said she was going to report the card stolen, my grandmother admitted the card was hers. She'd given it to a neighbor who said they needed money. One of her “friends,” like Montel Williams.

Leafing through pages and pages of my grandmother's credit history, we were horrified to find that the $500 Capital One card was the least of her credit card secrets. At one time, she owed Bank of America a little over $20,000, but that account had been in collections for almost two years, purchased by a company called Asset Acceptance, that had bumped her debt all the way to $28,000 and put a lien on her home, the one my father built for her just a few years ago.

The envelope with Montel Williams on it was from a company called MoneyMutual. Montel promised, “Get up to $500 deposited into your account by tomorrow!” The information in the envelope was confidential, exclusively for the “member,” and assured my 84-year-old grandmother, who believes the city inspects her garbage for recycling and will fine her if they find any, “Your Emergency Cash Card has been activated and is ready for you to use. Keep it in your wallet or near your computer so that your personal Reservation Number is always handy.” Much like the neighbor running up her Capital One card, Montel Williams was her “friend,” always ready to lend her money if she needed it. On the back of the MoneyMutual letter, the fine print reads, “www.MyMoneyMutualNow.com is not a lender, an agent, a broker, or a representative of a lender, and does not make cash advances or lending decisions. MyMoneyMutualNow.com will provide your information to lender(s) that offer short term loan products.” In other words, MoneyMutual would happily give my grandmother's name and finances to whoever was swimming in the low end of the shark pool. Thanks, Montel.

My grandmother lives on food stamps and social security checks, but companies like Aspire Visa, Bank of America, HSBC, Chase, Upfront Rewards and even Barclays Bank of Delaware have been extending her enormous credit lines over the past five years. She had limits as high as $15,000 dollars on some of these cards, which she would use and then roll onto another card as soon as she had trouble making the payments. Some time during 2009, she stopped being able to keep track of which cards were canceled and which were due, and stopped paying all of them. The companies wrote off the debts, and various collection companies scooped them, including Asset Acceptance, a collection agency notorious for its tactics. The lien on the house is likely their doing, but my grandmother can't tell us anything about how it happened.

According to a recent article on the New York Times website, heavy credit card debt among the elderly is exploding in recent years, with seniors “regularly swiping cards to pay for things like gas and groceries.” The balances pile up, leaving it difficult for them to cope by themselves. The same article cites a study by Demos, a public policy research organization: “The growing reliance on plastic has driven the average credit card debt for people over 65 to $10,235.” My grandmother owes three times that amount.

A few years ago, when my grandmother was just starting her life in Florida, she mentioned a few of the credit card offers she'd accepted as though it wasn't a big deal. “I asked my lawyer, and he said that no one has to pay those bills after I die. So why not?” My parents were skeptical, but neither of them believed a credit card company would extend much credit to an old woman on social security. I tried to tell them that these same credit card companies extended credit to freshman college students living off SallieMae loans.

My grandmother's lawyer was only half right. In a column posted on www.creditcards.com, a woman named Roberta wrote in asking about a similar situation with her elderly mother's credit card debt. Roberta's mother and my grandmother are both what Harry S. Margolis, Boston Attorney and president of ElderLawAnswers (http://www.elderlawanswers.com/), call, “'Judgment proof,' meaning the credit card companies may be able to sue her, but they can't collect anything if there's nothing to collect.” Credit card debt is unsecured debt, which is why collection agencies will try so hard to convince you to pay them. Unsecured debt won't live on after my grandmother's death, but somewhere between running up almost $30,000 in credit debt and now, that unsecured debt became firmly anchored by her house through a lawsuit or a home equity line of credit she doesn't remember agreeing to through a lien. When the house passes completely to my father, the lien and her $30,000 worth of debt will go with it.

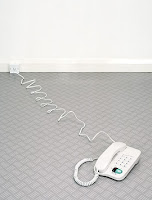

Every morning, I remind my grandmother to take her pills, and every morning, she asks a short while later whether she took them or not. Despite a failing memory, she gets mail almost daily from her “friend,” Montel Williams, who wants her to borrow more money. Her calendar on the refrigerator still shows the due date for the last cash advance a local check cashing store forwarded her against her social security check. My grandmother used to keep a detailed record of every phone call and transaction in a notebook. I've read through the entries during the period where she stopped paying her credit-card statements, trying to find a clue to how the debt became so huge, why it became tethered to the house. All I found were a few confusing scribbles about lost credit cards and this note, dated March 19 of 2010, “Letter from Bank of America Attorney – left message, no way I can pay them, do what they want.” Her handwriting grows erratic after that point, and the notes stop altogether in early 2011. One of the last entries was that she sold some of her custom jewelry for $100.

My grandmother's phone never stops ringing, but it's not collection calls. Those must have stopped when Asset Acceptance placed a lien on her house. The calls are from dozens of my grandmother's “friends,” all the people she used to do favors for. “I've done a lot of good for a lot of people,” she said to me the other day. I believe her. $30,000 worth of favors, including credit cards to friends and paying other people's bills and lending borrowed money to people who neither me nor my parents have ever met. My mother wants me to be polite when these friends come to visit because we don't know the whole story. We'll never know the whole story. So I smile and shake the hands of these strangers, like the woman who borrowed the credit card, but whenever Montel Williams pays a visit, I tear him in half and toss him in the trash.

Labels: asset_acceptance, debt, debt_collectors, Edible_Consumer, elderly_credit_debt, moneymutual, montel_williams

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE --> SITEMAP <-- |