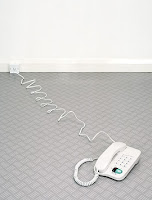

"Can You Fear Me Now?" One Family Learns Verizon's Definition of a Payment Arrangement is Paying to Talk to a Supervisor

|

| Can You Fear Me Now? |

I signed up with Verizon last Christmas after almost weekly visits from their well-heeled, door-to-door pitchmen. $99 a month for cable, phone and Internet service sounded very tempting and after months of troublesome service with our then-current provider, Bright House, my wife and I agreed to give Verizon a try. I made the call and found out that the impressive $99-a-month offer was even sweeter than I thought. For three months, we would get all the premium cable channels along with phone and high-speed Internet service. Just like that, I was sold. More specifically, I was obligated as signing up with Verizon cable service is strangely like signing up for cell phone service or a credit card. I was given a credit check, one that I miraculously passed despite the certain knowledge that I had an outstanding bill for a prematurely canceled Verizon cell phone. Then I was subjected to five or more solid minutes of “fine print,” as the woman read me pages and pages of legal disclaimers. Just as I was starting to have a funny feeling about all of this(and wondering if my first-born child had just been promised to the Verizon corporation), the woman congratulated me on my one-year contract with Verizon FIOS.

Just like that, I had another contract with Verizon, complete with penalties if I decided I didn't like their service and wanted to cancel. On the upside, I had every channel and a new phone line along with some incredibly fast Internet. Contract cable was a cage, but it seemed to be a very nice cage.

Then the telemarketing calls started. Within two days of turning on our phone, we started receiving three to five calls a day from unknown or inexplicable numbers. Unlike our previous cell and land line numbers, the Verizon cable phone number somehow made it into every call center in the country. At first, we simply turned the ringer off and scanned the Caller ID list every so often for a familiar number, but the sheer volume of calls quickly filled the Verizon voice-mailbox and friends and family grew too frustrated to bother calling.

After three months, we decided to see if we could change our plan to keep some of the premium cable channels and drop the useless phone service. Verizon politely informed us that the phone service was the only part of our contract that was non-negotiable. We could add additional lines and pay for a service that blocked anonymous numbers, however(a service that was later discontinued).

Even more incredibly, our bill had gone up as they canceled the premium channels. By the next billing cycle, our bill climbed to $150 a month for basic cable, a phone that was only useful for outgoing calls, and Internet.

One of the things we signed up for with Verizon was a Digital Video Recorder, which allowed us to record movies and television shows for later viewing. At about $5 extra every month, it was a minor expense we were glad to pay for(unlike the phone). After losing the upper tier cable channels, however, anything recorded from a premium channel mysteriously disappeared. Our Digital Video Recorder was apparently a Digital Video Borrower and Verizon could take back our recordings whenever they felt like it.

While losing recordings was infuriating enough, the DVR began behaving strangely. From the beginning, we noticed a slight delay between pressing a button on the remote and the box responding. After several months, the box began to freeze up when trying to access On-Demand programming or shows recorded on the DVR. The video would blink out and nothing short of unplugging and resetting the box could restore service to normal. Verizon's helpful tech support sent us a new remote that did the same thing and told us to reset our box whenever it froze. (Yes, they actually suggested that the remedy to constantly having to reset the box was to reset the box.)

A lightning strike in our neighborhood shorted out every phone in the house and we learned that Verizon does not repair or replace equipment damaged by lightning unless you pay for their lightning insurance plan. Was this information buried in the legal disclaimer monologue I received on signing up? Probably not, but it's impossible to be sure. Tired of dealing with the Verizon phone altogether, I bought a MagicJack(a portable phone line that can be plugged directly into your computer if you have working Internet) for $20. For such a low price, I wasn't expecting miracles but the device performed as advertised and had no hidden costs. I did, however learn that Verizon imposes strict limits on their Internet service. Specifically, you can download as much as you like at the best possible speeds but your uploads are capped. What this means is that devices like MagicJack and Skype function very poorly. You'll hear the person on the other end with crystal clarity but they may not hear you at all. I find it hard to believe these technical problems are unintentional on Verizon's part, as they pay a great deal of money to lobby for tighter control of the Internet and to impose restrictions on VOIP (Voice-Over-Internet-Protocol, the technology that allows Internet users to use their computers as Internet phones).

As our Verizon bill continued to creep upwards, it became more and more difficult to make our contractually obligated payments. Our service was disconnected once or twice, always reconnected remotely once we paid(a remarkable technological feat, but just as expensive as sending someone to manually connect or disconnect service, as the $30 reconnection fee seemed to indicate). Our last two bills somehow topped $200, which would have been the breaking point if our contract was not so close to ending anyway.

Taking the advice given on a previous call to Verizon, I decided to use their payment website to make a payment arrangement so our service would not be disconnected in the weeks it would take to put together enough money to pay our insanely high bill. I chose the maximum offered date, agreed to allow the website to debit my bank account for the amount owed on that date, and then I pressed “submit.” Verizon emailed me a receipt:

Confirmation of payment arrangement

Dear verizon.com customer,

Thank you for using verizon.com to make a payment arrangement for one installment payment. Please keep a copy of the confirmation below for your records.

Your Payment Information

Today's Date:

10/17/2009

Time:

4:20:16 PM EST

Scheduled Payment Date:

11/18/2009

Scheduled Payment Amount:

$270.32

Last 4 Digits of Your Phone Number:

XXXXXX****

Your Confirmation Number:

10746***

Please be sure to adhere to this schedule in order to avoid any interruption in service.

Questions about your service? We're here to help, so please visit us online and we'll be happy to assist you.

Thank you for allowing us to serve you.

Sincerely,

Verizon

Imagine my surprise when Verizon disconnected my service on November 16th, two full days before I had agreed to pay them and they had agreed to wait. A payment arrangement is, after all, a contract between two parties and Verizon is definitely a fan of contracts. I received an email from them confirming the arrangement. Since the payment date was only two days away, I drove out to a wireless hotspot and paid online(the website informed me that I could restore my service by only paying $47 and change, but I went ahead and paid the full $270). Then I went home and plugged in my Verizon phone line so I could speak directly to the fine young cannibals at the Verizon Call Center and find out what was going on. Even when your phone service is disconnected, Verizon conveniently leaves a direct line straight to their payment call center if you follow the prompts correctly.

James, Verizon's finest, informed me that I owed $270.32 and could have my service turned back on as soon as I greased his palm with the green(the $47 bill promised by the website was, as I suspected, too good to be true). Curiously, a payment made online and a payment made to the call center are not the same thing. James had no record of my payment, but he said that my service would be back on within 24 hours if I did indeed make that payment. When I asked why my service had been interrupted a scant two days before our arranged payment date, things took a turn for the bizarre.

“A payment arrangement will not actually debit your account,” James said. “What you made was an agreement to pay. Your service can still be disconnected if you've made an agreement to pay.”

Aside from being patently illogical, that wasn't what I'd done. I explained that I had an email confirmation(shown above) of a payment arrangement, not an agreement to pay, and it made no sense to me that my service was disconnected before the arranged date.

James repeated that one was not the same as the other, and I realized he wasn't even responding to my question. He was still trying to explain the difference. I reiterated that I had a payment arrangement(and would email him the proof just as soon as he turned my Internet back on) and asked why my service was disconnected prematurely. He ignored my question again to explain the difference between agreement to pay and payment arrangement. Yes, if I had made a payment arrangement, they would not have disconnected my service, but that was not the case if I merely created a payment agreement. Very calmly, I explained that he was either calling me a liar, deeply confused about my grievance, or Verizon intentionally deceived me when it approved my payment arrangement. I didn't care which; I just wanted to speak to a supervisor.

“I can't put a supervisor on the line, but I can have a supervisor call you back if you'd like.”

“A supervisor can't call me back. You've disconnected my phone.”

“I understand that, sir. Would you like a supervisor to call you back?”

“Please connect me to a supervisor as you've just agreed that having one call me back is impossible.”

“I can't do that, sir.”

Long silence.

“So what you're telling me is that you can't help me and you have no useful information whatsoever?”

Longer silence.

“...your service will be reactivated within 24 hours.”

I thanked him and wished him all the best. Several hours later I spoke with another customer service agent and asked about their supervisor policy.

“If my service has been interrupted and I make a payment, a payment that your website shows but your call center does not register, you will not reconnect my phone service, correct?”

“Correct.”

“And your policy is that supervisors will not get on the line. They have to call the customer back, even if you've disconnected their phone.”

“That's correct. The customer must pay their outstanding balance in order to reconnect their service.”

“Just so I understand you, your company's policy is that a customer will not be allowed to present a grievance to a supervisor unless they pay, even if the grievance is that they have paid and their service is still disconnected?”

“That's correct.”

I no longer believe that a contract with Verizon is a gilded cage. It's just a cage, and like any other prison cell, it exists to protect your jailors from you, whether or not you're actually guilty. My parents stole cable when I was a kid, but what I call stealing involved paying their monthly cable bill. Who among Verizon's customers now feels that time and unprecedented corporate growth has reversed that quaint irony. We pay our cable bills, but in turn it feels as though something is being stolen from us.

I signed an agreement with Verizon, an agreement in which they seemingly handed my personal information to every telemarketer in the United States, stole movies from me that I'd paid for but not actually watched yet, and reneged on a payment arrangement because their power is so great that they can make two plus two equal five and reverse the meaning of payment arrangement by simply reversing the order of the words. If I want to speak to someone with the power to answer my grievances, I need to pay my bill twice so they can call me back or try to squeeze a message into my spam-filled Verizon voicemail. My payments to the Verizon website eventually posted, but what if they didn't? Do I take my MagicJack down to the library and patiently wait for Verizon's customer service supervisors to call me back on a public terminal(where I'll hear them with crystal clarity while they can't hear a word I say because of bandwidth limits)?

My next payment to Verizon will be almost $200 for roughly the same services originally promised at $99. I will be released from Verizon no sooner than the week after Christmas, as I am ineligible for parole under existing terms and conditions.

Labels: billing, Edible_Consumer, payment_arrangements, verizon

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE --> SITEMAP <-- |