Can You Get Student Loans Discharged When You File for Bankruptcy?

|

| Can You Get Student Loans Discharged When You File for Bankruptcy? |

I think it's safe to say that default rates are on the rise again.

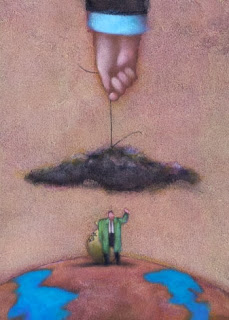

So, many borrowers who are considering filing for bankruptcy have defaulted student loans as well. The problem, however, is that generally student loans aren't dischargeable via bankruptcy. In fact, there is very little consumer protection involved with student loan debt in any respect. Such borrower vulnerability is the inspiration for a gripping new film, Default: the Student Loan Documentary. The trailer for this documentary sheds a lot of light on how student loans are some of the most dangerous financial products of our time:

The current recession is sure to cause many other borrowers to default on their student loans, and this may come as they are already considering filing for bankruptcy. The lack of basic consumer protections like the right to refinance, Fair Debt and Collection practices, adherence to usury laws, Truth in Lending requirements, and statutes of limitations build a financial trap that many college graduates cannot escape in a poor job market. Because so many borrowers are uninformed about their financial rights and responsibilities when they acquire these loans, the lack of bankruptcy protection can come as a shocker when it comes time to file. Most people filing for bankruptcy cannot get their student loans discharged.

However, there is a small group who can...technically. If you find yourself experiencing such a great hardship, as in the case of a crippling disability, that you feel you cannot pay back your student loans you can indeed file a separate motion for the discharge of that debt.

But how often does that happen?

How Hard Is It To Get Your Student Loans

Discharged Because of a Disability?

Discharged Because of a Disability?

Unfortunately, it is extremely difficult, even in an exceptional case, to get your student loans discharged.

The truth is that most borrowers will never actually be so financially burdened that they can prove that they would never be able to pay back their student loans. AllExperts.com adds,

"...Court decisions that find undue hardship for the debtor have been extremely rare in the reported case decisions. A review of the reported court decisions in this area will disclose that most undue hardship discharges that have been granted typically go to individuals that suffer from some type of very severe permanent and total disability or some sort of permanent disability that drastically restricts the ability of the debtor to more than a subsistence level of income. The courts require a finding that the debtor has proven each of the following three elements:

- That the debtor cannot maintain, based upon current income and expenses, a “minimal” standard of living for himself and his dependents if compelled to repay the student loans; and

- That additional circumstances exist indicating that this state of affairs is likely to persist for a significant portion of the repayment period of the student loans; and

- That the debtor has made good faith efforts to repay the student loans..."

Furthermore, if they indeed did meet such qualifications, retaining legal counsel would probably be just as burdensome, preventing them from taking legal action at all. Therefore, in all practicality, it is nearly impossible to get your student loans discharged when you file for bankruptcy. If you do file for bankruptcy, you will still have to find a way to pay your student loan debt. It will only continue to compound if you ignore it; you simply have to pay it back.

So, I guess that there are three guarantees in life - death, taxes, and student loan debt.

Labels: bankruptcy, settling debt, student_loan_debt, student_loan_justice, student_loans

|

--> www.FedPrimeRate.com Privacy Policy <--

CLICK HERE to JUMP to the TOP of THIS PAGE --> SITEMAP <-- |

5 Comments:

And it's a trap that most students aren't aware of when signing. I remember when I was in college, they had a meeting and said basically, "Sign your name here and we'll give you money." Most people in the room did sign their names and then found out the terms.

Student loans should be like any other debt as far as bankruptcy. Predatory lending is never a good thing and we are finding out in this country what path it leads us down.

I am graduating with almost 100k of student loan debt, and NOT going be to making big bucks to pay it off. I regret all the loans I took out, but now I'm stuck with the debt. I've been applying to loan repayment programs with no luck. I'm desperate and don't know what to do. How can I pay off my loans with a salary of $40k a year??? And what is the best consolidation program out there?

> what is the best consolidation

> program out there?

I hear you. I was in your shoes, and this is what I did:

1) Consolidated my loans with William D Ford:

http://www.loanconsolidation.ed.gov/

Highly recommended, as they will treat you fairly.

2) Opted for the income contingent repayment option, which kept payments affordable.

3) As soon as I was able, I paid of the debt off. I was lucky enough to pull down some decent cash during the housing boom years.

I paid my student loan debt off before my credit card debt because, if I ever had to declare bankruptcy, the credit card debt would be dischargeable, whereas it's virtually impossible to discharge student loan debt with bankruptcy.

Excellent post and great information! Since students loan can't be included in bankruptcy, and it is not discharged, one should take care to make a repayment plan right from the day he is going to apply for it.

Great post here. It was nice reading this article bout students loans and bankruptcy.

Post a Comment

<< Home